No! The ONEfee is not the only fee when it comes to your investments with OUTvest. To make a true all-in-fee comparison across RA providers, you have to take into account the ONEfee plus the underlying costs of the investments. And whilst the underlying costs of the investment are subsidised in part by the ONEfee, the ONEfee does not cover all fees! Specifically, Securities Transfer Tax (STT) still needs to be paid. And the costs amount to as much as 0.36% within the most popular OUTvest fund historically. So to answer your question - No(!), OUTvest's ONEfee is not the only fee when it comes to your investments with OUTvest.

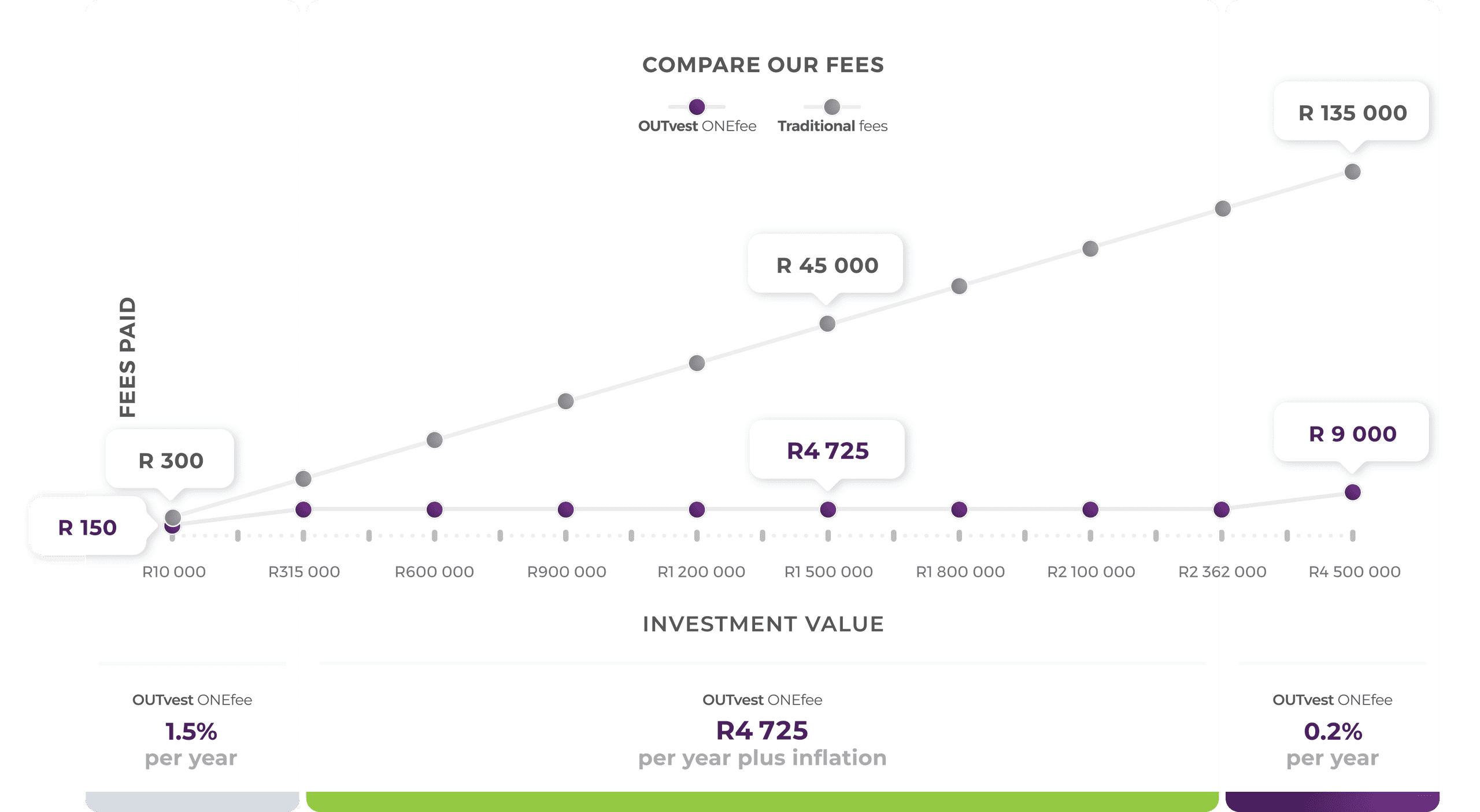

Source: OUTvest's website showing the ONEFee vs traditional fees

What is the OUTvest ONEfee? The ONEfee is an administrative platform charge & covers a large part of the underlying investments. Here is the statement on the OUTvest website. "On your statement, you will see one fee deducted from your investment every month for the administration of your investment [...]".

The ONEfee starts at 1.5% for amounts smaller than R315k. It is fixed at R 4 725 per year if your investment value is between R315k and R2.36m and is a mere 0.2% per year for amounts greater than R2.36m.

In addition to covering administration costs, the ONEfee also covers "[...] advice and fund management [...] – no hidden fees." This is a first, which I know of, in this industry. 😍 Hats off 😍!

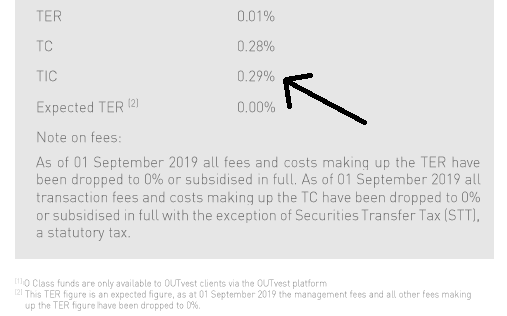

What are we missing? 🤨 The small print on the fund fact sheets. That's what we are missing. Whilst the ONEfee covers fund management fees and even brokerage charges, it does not cover STT. Or Secondary Transfer Taxes. These are statutory taxes the OUTvest fund - or any other fund for that matter - needs to pay when buying underlying securities on the JSE. Since this is a fee within your underlying investment, you do not see this fee on your OUTvest statement. So unlike the ONEfee, this STT fee does not get deducted. However, you will see these fees disclosed on the fund fact sheets of your OUTvest fund. It is important to take these into account when doing an all-in-fee comparison as they are still fees (specifically taxes) your underlying investment pays - thus reducing the overall value of your underlying investment.

Here is an example of the OUTmoderate index fund fact sheet for end May 2021 showing TC (or transaction costs) of 0.28%. You need to add this fee to your overall costs to get you to an all-in-fee.

PS. the July fund fact sheet quotes a 0% TC. This is a mistake in my view. Let us see if OUTvest corrects this...🥴

Is OUTvest lying about the ONEfee? It is very misleading to say it politely. Naming something "ONEfee" suggests that this is the only fee. ONEfee is just one fee, right? Well.. not quite as we just found out. So whilst the ONEfee covers the platform fee & a large of the underlying investment costs, it does not subsidise and cover the Securities Transfer Tax (STT) which your underlying fund needs to pay. The impact of the STT comes through in the Transaction Costs (or TC) on the fund fact sheet.

How big is Securities Transfer Tax (STT) within a fund? An OUTvest fund - managed by CoreShares - just like any other fund - will incur STT when buying securities on the JSE. They need to buy securities when they see new inflows into the fund or need to rebalance the fund to its target asset allocation weights. I have been tracking the transaction costs - as shown on their fund fact sheets - since March 2020 for the OUTModerate index fund. Here are the costs. They have been ranging between 0.29% - 0.36%. As the fund grows and inflows start to slow down, one can expect this fee to come down.

| Dates | TER | TC | Total investment charge | ||

|---|---|---|---|---|---|

| OUTmoderate Index Fund fact sheets | April - June 2021 | 0.01% | 0.28% | 0.29% | |

| OUTmoderate Index Fund fact sheets | Jan - Mar 2021 | 0.01% | 0.33% | 0.34% | |

| OUTmoderate Index Fund fact sheets | Oct - Dec 2020 | 0.03% | 0.36% | 0.39% | |

| OUTmoderate Index Fund fact sheets | Jul - Sep 2020 | 0.06% | 0.29% | 0.37% |

* source: me, independently tracking the OUTvest Moderate Index fund transaciton costs from the OUTvest fund fact sheets.

Where does this leave me personally when it comes to investing with OUTvest? OUTvest's fee model is revolutionary. At the top end, a 0.2% incl of VAT fee which covers majority of fees is seriously impressive! These cover admin charges, fund management and a large part of the underlying expenses with your investments. Even when adding the current TC - which one can expect to decrease over time - the fees are still superb! Not many RA providers come close. But, the mere fact that their current tools - including their online EAC tool, marketing and website - are misleading, I will give this a pass. A better tactic in my eyes would have been to come out and openly say "Hey, as the funds are growing, you have to take into account STT (as disclosed in the Transaction Cost) on our fund fact sheets. We show this TC in our EAC tools when providing a quote.". But they are not doing this. Right now, I feel the communication is misleading & merely mentioned in the fund fact sheet's fine print...

But who really reads the fine print? In this case, I did. And since I am showing OUTvest on my RA comparison tool, I wanted to share my findings with you.

Thoughts and criticisms on this piece are welcome 👇.