Are outves

"The fees displayed in your calculator differ to Outvest's fees as shown on their website. Why?" (email from reader)

It is true. The fees I show in my calculator differ to the fees given on the OUTvest website. In this article, I dig why these fees differ & what I believe you should take into account when comparing fees across different RAs.

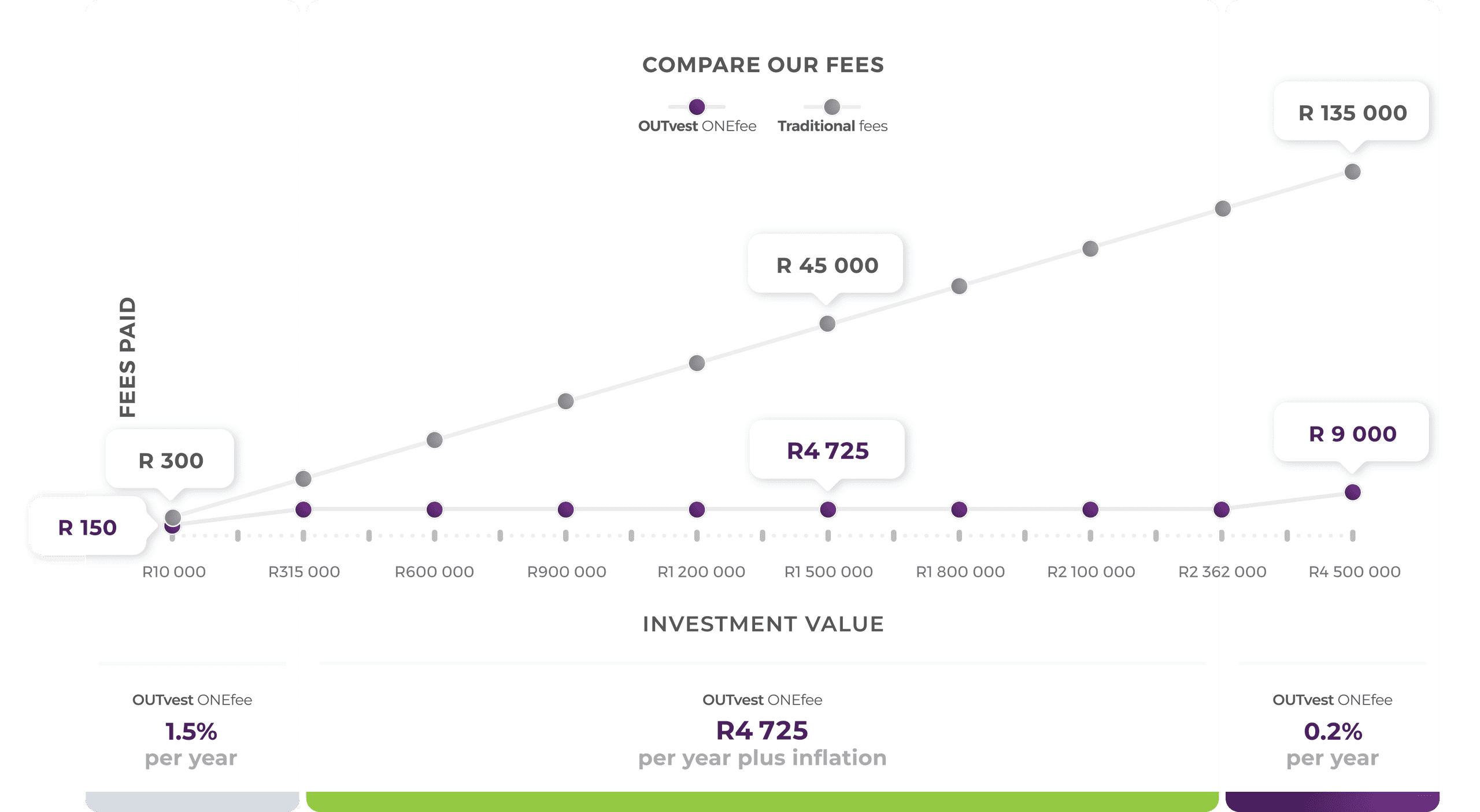

Let us start at the beginning. Here is what OUTvest shows on their website.

According to OUTvest you pay ONEfee according to the table below

- 1.5% per year for portfolio amounts smaller than R315 000.

- A flat fee of R4 725 per year + inflation if your value is between R315k and R2 362 500

- 0.2% per year for portfolio amounts greater than R2 362 500.

This is different to what I take into account in my calculator. What does my RA fee calculator use for calculating OUTvest fees?

- 1.5% + 0.29% per year for portfolio amounts smaller than R315'000.

- A flat fee of R4 725 per year + 0.29% if your value is between R315k and R2 362 500

- 0.2% + 0.29% per year for portfolio amounts greater than R2 362 500.

And thus we end up with a difference when using my calculator

This is quite a difference from what Outvest is highlighting on their website. What's the difference? 0.29%. That is the difference between what I use in my calculator vs fees shown in OUTvest's fee chart.

| Portfolio amount | OUTvest fee | My calculator | Difference |

|---|---|---|---|

| smaller than R315'000 | 1.5% per year | 1.5% + 0.29% | 0.29% |

| between R315k and R2 362 500 | R4 725 per year | R4 725 + 0.29% | 0.29% |

| greater than R2 362 500 | 0.2% per year | 0.2% + 0.29% per year | 0.29% |

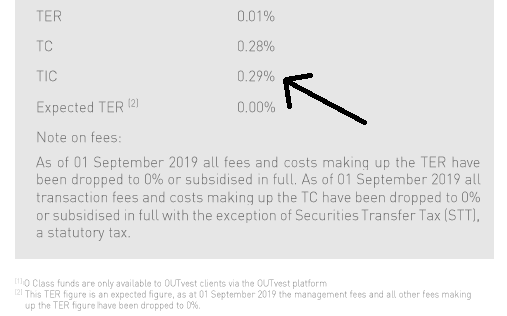

Where does that additional 0.29% come from? It is the TIC, or Total Investment Cost, of the underlying investment.

I am using the OUTvestModerate Index fund in my calculator as this is a Reg28 compliant fund (note, the OUTvest Aggressive index fund is not Reg28 compliant & thus cannot be used for RA investments) and sits in the High Equity ASISA sector. Thus is most appropriate choice for majority of individuals looking for an RA.

Why take into account the TIC of the underlying investment? In order to make a true comparison across different RAs, you should take into account all fees. These are admin or platform fees, total investment cost of the underlying investment and advisor fees. I am omitting advisor fees from my calculator, but I am taking into account both the admin fee and the total investment cost of the underlying investment.

What makes up Transaction costs? A focus on Total investment costs. Transaction costs can be high when funds experience large inflows.